Iran Blacks Out. Sanctions Go Kinetic. Finance Splits

IN THIS ISSUE:

From the Executive Editor

At the Edge of Agency

The year ahead is unlikely to be defined by a single technological, geopolitical or economic shock, but by a growing clarity about where human and organizational agency lies as these three dimensions collide. In 2026, the world’s most consequential choices are being made inside technology stacks, data architectures, business models, and investment theses that quietly shape how value, power, and perception are created. Physical AI is moving from experiment to operating reality across factories, cities, and infrastructure. Tech sovereignty is becoming a strategic design problem spanning compute, capital, and standards. Collaborative productivity between AI and humans is becoming a discipline that defines our prosperity. And AI and data are increasingly decisive in cognition and reality contests.

Yet this is also a moment of opportunity. GeoTech Radar focuses on the space where foresight becomes strategy, tracking weak signals, connecting engineering decisions to market and geopolitical outcomes, and illuminating how disciplined innovation, capital allocation, and institutional adaptation can still bend the trajectory of the decade ahead.

UNFOLDING NOW

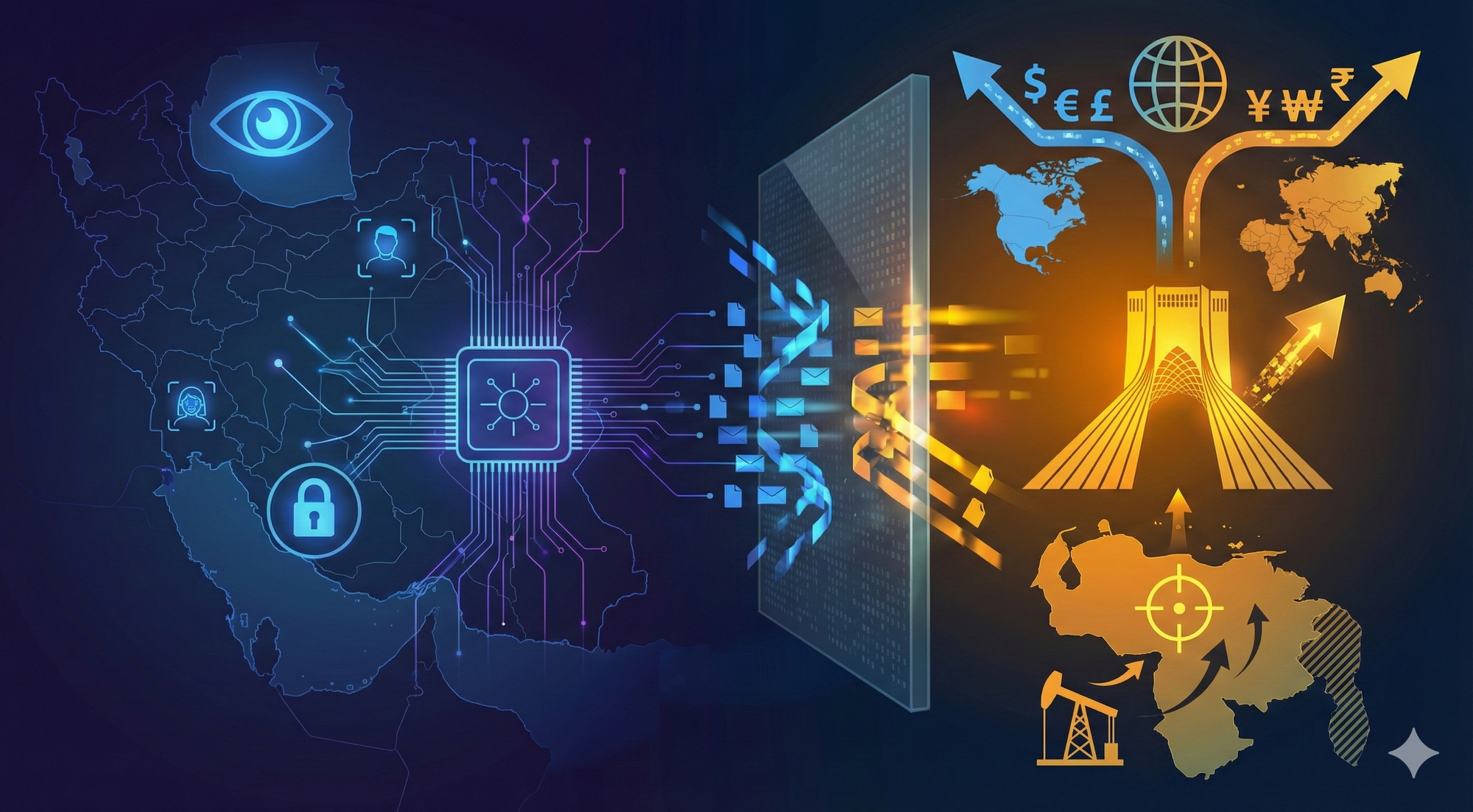

Coordinated internet shutdowns seek to shield security forces conducting lethal crackdowns from international scrutiny, while AI-enabled identification systems aim to eliminate protesters’ traditional “safety in numbers.” According to a 2024 European Parliament report, Iran procured surveillance technology through partnerships with China, Turkey, India, and UAE. Chinese firms Tiandy Technologies and Dahua supply AI-enabled cameras and facial recognition software. The same report identifies UAE as “the largest exporter of components, including most of the hardware infrastructure,” though specific hardware categories are not detailed in available sources. Meanwhile, protesters rely on thousands of smuggled Starlink terminals to bypass the blackout. Iran has responded by deploying military-grade jammers achieving 30 to 80 percent packet loss and actively hunting users. The Wall Street Journal reports security forces now track high-frequency signals from Starlink dishes, conducting physical raids to locate and arrest users. Trump plans to discuss expanding Starlink access with Elon Musk. The January 8 nationwide blackout, worse than 2019’s “Bloody Aban” massacre, coincided with Crown Prince Reza Pahlavi’s call for mass demonstrations, suggesting real-time intelligence monitoring. The crackdown follows June 2025 US-Israel nuclear strikes and occurs amid Iran’s regional collapse (Hamas degraded, Hezbollah decimated, Assad overthrown). With 1,500 executions in 2025 and reports of Khamenei’s Moscow evacuation plan, this represents the regime’s gravest legitimacy crisis since 1979.

WHY THIS MATTERS:

Macro: This tests whether AI-enhanced authoritarianism can suppress mass movements in the satellite internet era. Iran transformed commercial surveillance technology into a comprehensive digital suppression architecture that sets dangerous precedent globally.

Meso: The case exposes critical export control gaps: sanctioned Chinese firms supply surveillance tech through third parties, while UAE serves as primary hardware conduit, walking regional tight ropes while leaning toward the West.

Micro: Starlink fundamentally changes protest dynamics one customer at a time by breaking traditional “kill switch” shutdowns, forcing regimes to escalate to military jamming and physical enforcement. This marks the first major conflict where private tech infrastructure directly challenges state censorship, raising questions about tech billionaires’ geopolitical role.

For policymakers, the stakes are enormous – Tehran regime change would reshape Middle East power dynamics and eliminate the primary state sponsor of anti-Western militants. It might also create a regional economic hegemon, if Iran’s economy were to become well run. The outcome signals whether digital tools favor liberalization or oppression.

For business, it highlights supply chain complicity risks. What is the “true north” for leaders in any given tech firm in terms of values at play domestically and internationally? Is the positioning one of an agnostic arms dealer? How will this implicate a brand’s trust rating across markets? What is the potential data debt accumulated and the regulatory scrutiny triggered across the globe? T.

ON THE RADAR

Three domains shaping the GeoTech landscape in 2026.

[DATA] DATA & STACK SOVEREIGNTY

The Tanker That Became a Weapon

The Venezuela interdictions exposed how oil-evader ecosystems are strategic connectivity between sanctioned producers and major buyers. The U.S. seized a China-bound tanker, prompting Beijing to condemn the action as a violation of international law.

These operations rely on a tech stack that includes AIS tracking, satellite surveillance, shipping data fusion, financial intelligence, and beneficial ownership screening—all converted into maritime interdiction and precision strikes. Reuters reported cyberattacks impacting Venezuela's PDVSA systems concurrent with the blockade campaign.

Why this matters: The "dark fleet" isn't just commercial evasion, it's geopolitical infrastructure. Expect tighter AIS anomaly detection, beneficial ownership enforcement, port controls, and interdiction capacity. This is a compute + data + enforcement domain where maritime intel vendors become quasi-strategic.

See “Under the Radar” section for deeper analysis

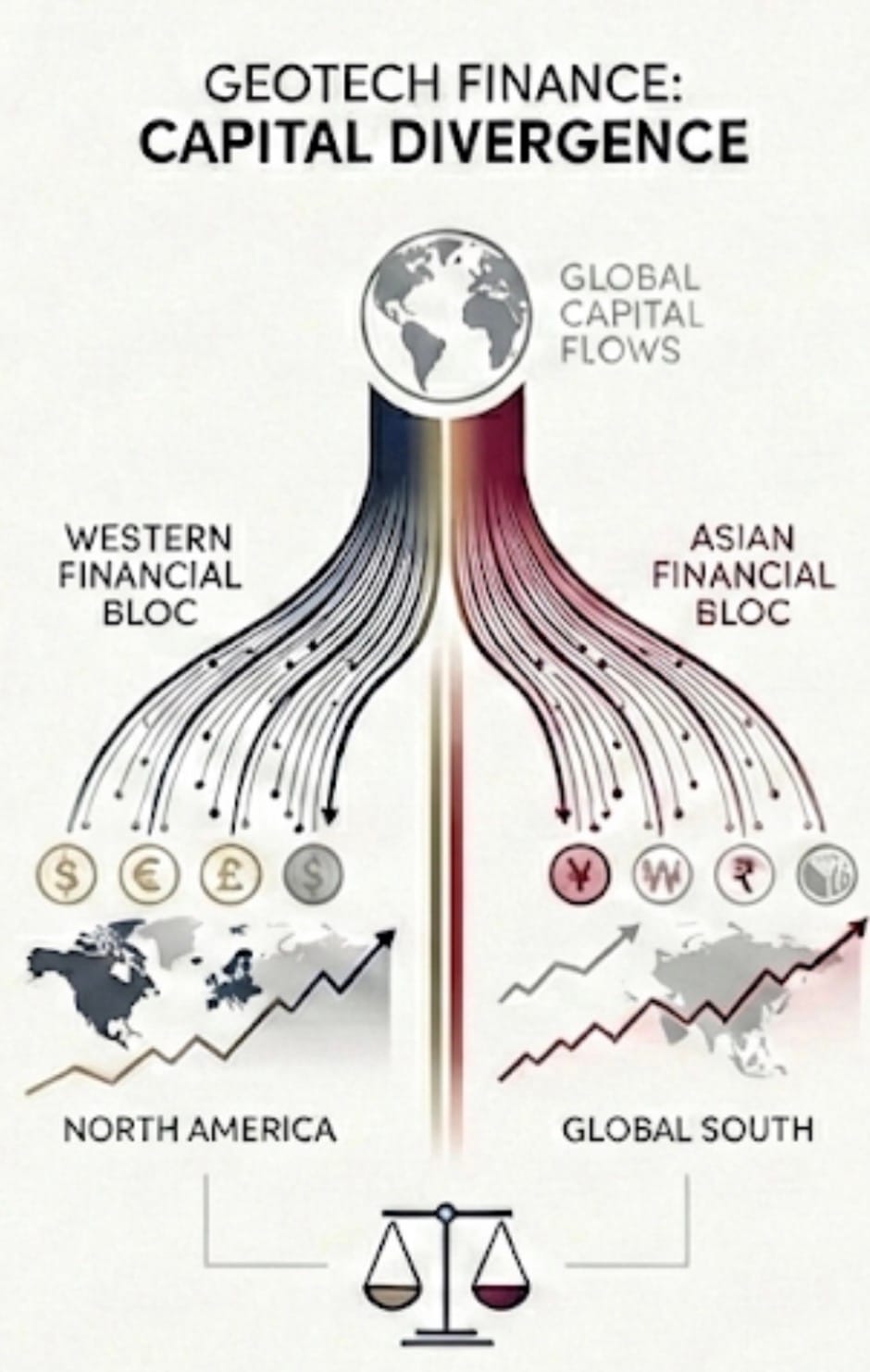

Banking's New Red Line: The AI Chips China Can't Buy But Can Still Use

At least nine bankers at global lenders have expressed private concerns that their firms could be caught in the crossfire of the U.S.-China AI battle. Some financing deals that would grant Chinese end-users remote access to advanced U.S. chips through overseas data centers have sparked internal debate about whether the risk-reward is worth it anymore. The impact reveals how cautious lenders are getting despite strong demand for AI infrastructure financing. While Chinese firms cannot directly buy Nvidia's high-end AI chips, they can legally access them through data centers in countries outside China. Now that legal gray zone is becoming a compliance minefield.

One deal that hasn't moved forward is a potential $300 million loan for Silicon Valley-based PaleBlueDot AI to purchase advanced Nvidia chips for use in Japan. The end-user client? Xiaohongshu, China's popular lifestyle platform also known as Red Note. The deal has been under discussion for at least four months. JPMorgan was involved in preparing marketing materials, though it's unclear if the bank will ultimately participate. For one Western bank that passed on a Malaysia data center deal, the risk of potential U.S. pushback was too high. Earlier in 2025, JPMorgan and Citigroup joined a banking group providing a $2.8 billion loan to Bridge Data Centers in Malaysia that included ByteDance as a client. The data center also had contracts with Singapore-based Megaspeed International, which the U.S. government is now investigating for potential chip smuggling to China.

Why this matters: As Olaf Groth, practice professor at UC Berkeley Haas, noted in the Bloomberg article: "For U.S. banks, financing AI chips or data centers that ultimately benefit a Chinese platform is no longer a neutral commercial decision. Instead, it's one that falls between the intersection of U.S. investment, export controls and national security." Here's what banks and investors need to watch: The backlash is swift and bipartisan. When Benchmark backed Chinese AI startup Manus AI, Republican senators called it aiding Beijing within weeks. Treasury sent an inquiry letter. Due diligence now requires asking where do the chips go? Who's the end user? What's the data center client list? Getting this wrong means regulatory scrutiny, reputational damage, and potential enforcement action.

Washington's Mineral Race: Eight Allies, One Target

The U.S. State Department drafted agreements with eight allied nations (Australia, Israel, Japan, Netherlands, Singapore, South Korea, UAE, UK) to strengthen supply chains for chips and critical minerals needed for AI technology.

The December 12 White House summit focused on energy, critical minerals, advanced manufacturing, semiconductors, AI infrastructure, and transportation logistics. Federal policy in 2026 will shift focus beyond rare earths toward high-risk minerals like antimony and tungsten. The U.S. is highly dependent on China, Tajikistan, and Russia for these materials vital in defense alloys and munitions.

Why this matters: AI data center expansion creates massive demand for copper, aluminum, titanium, and magnesium, which are all energy-intensive to process. With rising competition for power from AI, electricity cost becomes a defining pressure point. Washington is prioritizing domestic processing and alternative technologies that reduce power consumption.

On Your Radar: Data sovereignty isn't about borders, it's about platforms. The systems that track ships, screen ownership, and convert intelligence into enforcement. Venezuela shows these layers integrated into kinetic action. Washington's mineral diplomacy shows allies racing to secure the physical dependencies that underpin AI infrastructure. The banking freeze shows capital flows becoming national security decisions. The race isn't just to control physical resources but to control the coordination infrastructure that weaponizes information itself.

[COMPUTE]TECHNOLOGY INFRASTRUCTURE

China to Chipmakers: 50% Domestic or Get Out

China quietly enforced a rule requiring new semiconductor fabrication capacity to use at least 50% domestically produced equipment. The directive—not publicly documented but enforced through procurement tenders—is Beijing's clearest move yet to strip foreign suppliers from its chip supply chain.

Applications below the 50% threshold are typically rejected, though authorities grant waivers for advanced nodes where domestic alternatives don't exist. But officials made clear that 50% is a baseline, not a ceiling. The long-term goal is 100% domestic equipment.

The policy is already accelerating breakthroughs. Naura Technology is testing etching tools on SMIC's cutting-edge 7nm production line. Advanced etching was dominated by Lam Research and Tokyo Electron. Now Naura and AMEC are partially replacing them.

Why this matters: The U.S. sees the 50% rule as proof that export controls are working by forcing China to build inferior domestic alternatives. But what if that's missing the point? China may be comfortable with two-way restrictions because this was never just about matching Western chip performance. It's about control and owning the data generated by domestic fabs, securing supply chains that can't be sanctioned, and building an ecosystem where Beijing sets the rules. The U.S. is winning a chip specs race while China is playing a different game entirely, one about sovereignty instead of speed.

CES 2026: When AI Leaves the Cloud and Walks the Floor

The biggest buzzword at CES 2026 was "physical AI,” Nvidia's term for AI models trained in virtual environments using synthetic data, then deployed as physical machines. CEO Jensen Huang unveiled Cosmos, an AI foundation model capable of simulating environments governed by actual physics, and announced the Vera Rubin AI superchip platform now in full production.

The shift is visible across the show floor. Qualcomm unveiled a full-stack robotics architecture for real-world industrial environments. LG debuted CLOiD, a humanoid robot for household chores. Boston Dynamics, Caterpillar, Franka Robotics, and NEURA Robotics showcased AI-driven robots for manufacturing, construction, and autonomous systems.

Nvidia framed it as "the ChatGPT moment for robotics,” heralding breakthroughs in models that understand the real world, reason, and plan actions.

Why this matters: AI is moving from software-only to embedded physical intelligence in drones, robots, autonomous vehicles, and industrial equipment. These aren't concept demos, they're production-ready systems backed by trillion-dollar companies. The industrial implications span manufacturing, logistics, defense, and infrastructure at scale. Will 2026 be the year of the robot?

On Your Radar: Tech competition is now about infrastructure access to chips, electrons, capital, machines, and factories. China's 50% rule shows industrial policy at scale. Banking scrutiny shows capital flows are national security decisions. CES shows AI hardware evolution is accelerating into the physical world.

[ENERGY] ENERGY-COMPUTE NEXUS

Sanders and DeSantis Agree: AI's Power Grab Has Gone Too Far

Bernie Sanders and Ron DeSantis agree on virtually nothing except this: The AI data center boom is a problem.

Sanders called for a national moratorium on data center construction. DeSantis is blocking projects in Florida. The bipartisan convergence signals a political reckoning over electricity prices, grid stability, and who pays for AI's infrastructure appetite.

The PJM Interconnection, the largest U.S. grid operator serving 65 million people across 13 states, projects it will be six gigawatts short of reliability requirements in 2027. Data centers accounted for $23 billion in power costs over three recent auctions. Those costs pass to consumers. Residential electricity prices are forecast to rise another 4% in 2026 after a 5% increase in 2025.

Why this matters: With 2026 mid-term elections looming and swing states like Pennsylvania and Virginia on the PJM grid, every politician will claim they have the answer to electricity affordability. If opposition reaches broad bipartisan consensus, it could slow the AI industry's development plans.

On Your Radar: When the progressive left and populist right agree, policy windows open fast. Data centers are now competing with households for power and losing the political argument. With midterms looming in swing states on the PJM grid, expect permitting fights, "AI tax" proposals, and politicians racing to claim they'll keep electricity affordable. The industry's expansion timeline just got a new variable: voter anger.

[DARK]UNDER THE RADAR

[FEATURE]CAMBRIAN PARTNER BY INVITATION: UKRAINE BECOMES THE WORLD'S WAR LAB

ABOUT CAMBRIAN

Cambrian Futures is a strategic foresight and advisory firm helping government, business, and technology leaders understand how emerging technologies intersect with geopolitics, markets, and national strategy. By combining rigorous research, AI-enabled analysis, and human expertise, Cambrian provides clear insight into global technology trends, risks, and power dynamics. Its work helps decision-makers anticipate disruption, manage uncertainty, and act with strategic confidence in an increasingly competitive GeoTech world.

PRODUCTION TEAM

GeoTech Radar is produced by the Cambrian Futures Insights Platform team:

CEO & Chief Analyst

Managing Director / Producer, Insights Platform

Deputy Producer, Insights Platform

Editor in Chief

Learn more about Cambrian Futures at cambrian.ai