Davos Signals Tech Decoupling, Chinese Labs Challenge Silicon Valley, Riyadh Bets Big

IN THIS ISSUE:

CEO's Perspective

Strategic outlook from Cambrian leadership

The most honest line spoken at Davos this year was long overdue. “We are in the midst of a rupture, not a transition,” Prime Minister Mark Carney said. The rupture did not begin in 2026. The world economic and security order has been eroding since the late 2010s. What made Carney’s words matter was their clarity. They named a reality not enough leaders have been heeding: Economic integration is no longer a stabilizer, it is leverage.

This issue of Geotech Radar shows how that rupture is playing out. Middle powers are no longer waiting for rules to be repaired. They are forming issue-based coalitions to regain leverage in a system where bilateral negotiations with hegemons increasingly result in weaker terms. Strategy has shifted from alignment to optionality.

Technology is where this shift becomes unavoidable. As we argued in The Great Remobilization, the global economy is reorganizing into a G2+X world. Two superpowers still anchor the system, but influence now flows through overlapping clubs organized around energy, finance, standards, data, and AI infrastructure. Cognitive and compute technologies have become the new fault lines and the new connectors.

The signals are concrete. DeepSeek’s rise and China’s AI advances, including architectures such as Kimi 2.5’s agent-swarm approach, show that capability, access, and cost now matter as much as scale. Micron’s memory bet underscores that constraints are shifting to infrastructure, not just capital or IP. Saudi Arabia’s sovereign AI push confirms that compute is now strategy.

For decision makers, the implication is clear. Assumptions of durable tech supremacy, frictionless diffusion, and single-stack global strategies no longer hold. Advantage will accrue to those who secure access to cognition, choose coalitions deliberately, and redesign organizations for a fragmented, compute-constrained world.

On the Radar

The signals affecting the GeoTech landscape this week

The Davos Rupture: Carney Calls Time on the Old Order

The 2026 World Economic Forum in Davos delivered a verdict that many had suspected but few had stated aloud. Speaking to a room of global leaders, Canadian Prime Minister Mark Carney said, "We are in the midst of a rupture, not a transition,” adding that the great powers are "using economic integration as weapons, tariffs as leverage, financial infrastructure as coercion, (and) supply chains as vulnerabilities to be exploited."

Carney's speech was not anti-American rhetoric, it was a call for strategic realignment among the global middle powers. "When we only negotiate bilaterally with a hegemon we negotiate from weakness," he said. "We accept what's offered." The solution, he argued, is coalition-building among other countries to create leverage.

French President Emmanuel Macron echoed the sentiment, framing the moment as "a shift towards a world without rules, where international law is trampled under foot." Writing from Davos, Council on Foreign Relations President Mike Froman observed that leaders are "abandoning strategies designed to change Trump's mind" and instead "focused on cooperating with each other to explore ways to exercise leverage in their relations with the United States and to lessen their dependence on it."

WHY THIS MATTERS: The term "derisking" was used by European Commission President Ursula von der Leyen to describe Europe's strategy toward China. Froman notes it is "now being deployed against the United States." Potential diversification away from the U.S. in trade and financial assets, development of domestic defense capabilities, and long-discussed agendas of reform are now top of the agenda. The rules-based order that the U.S. built and maintained for 80 years is being torn down by the very superpower that led it.

SO-WHAT: If your supply chains, partnerships, or market-access strategies assume U.S.-allied policy coordination, stress-test those assumptions now. "Fortress North America" as a unified trade bloc is no longer a safe premise. European procurement decisions, Canadian trade policy, and allied regulatory frameworks could increasingly diverge from Washington's preferences. Boards should scenario-plan for a multipolar economic order where middle-power coalitions create their own rules.

DeepSeek's Global South Gambit

Microsoft's AI Economy Institute released data showing that Chinese AI platform DeepSeek has captured market share in Africa, as well as in countries under U.S. sanctions or with limited access to Western technology. In fact, the company's share in those countries rose at two- to four-times the rate of its growth in other regions. In China, DeepSeek commands 89% of the AI market, with a major share in each of Belarus (56%), Cuba (49%), and Russia (43%). In African nations such as Ethiopia, Zimbabwe, Uganda, and Niger, it holds 11% to 14% market share.

The driver is simple economics. While OpenAI charges $20 a month for premium ChatGPT features, DeepSeek offers comparable capabilities for free under an open-source MIT license. DeepSeek has become the default chatbot on most Chinese-made phones, and Huawei bundles access with its cloud computing services across Africa.

Western governments have responded. Australia banned DeepSeek from all government devices. Italy blocked it outright because of data-privacy concerns. Germany asked Apple and Google to remove it from app stores. And the Czech Republic banned public administration from using it.

WHY THIS MATTERS: According to Microsoft's report, "Open-source AI can function as a geopolitical instrument, extending Chinese influence in areas where Western platforms cannot easily operate." DeepSeek's adoption pattern maps precisely to countries under Western sanctions or with strategic opposition to U.S. policy. When Western platforms can't operate, users adopt what's available. The U.S. AI diffusion policy restricts exports to adversaries while granting exemptions to 18 allies and limiting access for 120+ other nations, many in Africa.

SO-WHAT: If you operate in emerging markets, particularly Africa, your AI stack might increasingly compete with Chinese alternatives that are free, open-source, and bundled with local infrastructure partners. The next billion AI users will probably emerge not from traditional tech hubs but from regions where DeepSeek is the default. For companies building AI-powered products for global markets, this bifurcation demands dual-track strategies.

Kimi K2.5: Another Chinese Lab Challenges Silicon Valley Dominance

Chinese AI companies are demonstrating capabilities that rival U.S. technology leaders, despite Washington's export controls. Moonshot AI released Kimi K2.5 this week, a model that orchestrates 100 AI agents in parallel and matches GPT-5.2 and Claude 4.5 Opus on agentic benchmarks at significantly lower cost. The model uses Parallel-Agent Reinforcement Learning to cut task runtime by 80% while handling more complex workloads.

DeepSeek simultaneously published research on DeepSeek-OCR 2, introducing "visual causal flow" to mimic human reading patterns with 91% accuracy. The timing was not coincidental. Chinese labs are racing to release capabilities before DeepSeek's anticipated announcement, anxious about being overshadowed. Alibaba launched a reasoning version of Qwen3-Max the day before Kimi K2.5 dropped. Ant Group announced a robotics model the day after. Zhipu released an image-generation model trained entirely on Huawei chips two weeks prior.

The release velocity reflects both technical sophistication and strategic urgency. Moonshot raised $500 million last month at a $4.3 billion valuation, with investors circling for another round at $5 billion. The company achieved something genuinely novel – a model with one trillion parameters, 32 billion active at any moment, capable of directing hundreds of AI agents simultaneously through tasks requiring sequential execution.

Beyond pure performance metrics, Chinese AI is achieving market penetration in regions where U.S. platforms face barriers. Microsoft data shows Chinese AI capturing adoption in Africa and sanctioned countries at rates two- to four-times higher than in open markets. DeepSeek holds 89% market share in China, 56% in Belarus, and 49% in Cuba. The distribution advantage comes from bundling with Huawei infrastructure already deployed through Belt and Road telecommunications projects.

WHY THIS MATTERS: The narrative of insurmountable U.S. AI superiority is eroding faster than policymakers anticipated. Chinese companies are achieving comparable capabilities through different architectural approaches, lower capital intensity, and despite restricted access to cutting-edge semiconductors. This undermines the foundational assumption behind U.S. export control strategy that denying advanced chips would create insurmountable technical barriers.

The Kimi K2.5 agent orchestration represents a different path to AI capability. Rather than throwing more compute at larger models, Chinese labs are innovating on coordination mechanisms and efficiency. The model requires serious hardware for local inference, but the economics work for cloud deployment through Moonshot's API while remaining inaccessible for consumer devices.

For businesses, this signals a bifurcating AI ecosystem where different regions will increasingly rely on different foundational models. Companies with global operations face decisions about whether to build on Western or Chinese AI infrastructure, or maintain costly dual-stack approaches.

SO-WHAT: U.S. tech executives face pressure from two directions. Chinese competitors are achieving comparable capabilities at lower costs while American firms navigate increasingly restrictive regulatory environments domestically. The assumption that U.S. companies would maintain generational leads in AI capabilities requires reassessment.

The strategic implication extends beyond commercial competition. If Chinese AI companies can achieve parity with significantly less capital and restricted access to advanced chips, export controls alone cannot preserve U.S. technological advantages. This could force more comprehensive industrial policy responses beyond component-level restrictions.

The sprint mentality among Chinese labs reveals competitive anxiety but also demonstrates rapid iteration velocity. When Alibaba, Ant Group, Zhipu, Moonshot, and DeepSeek all release major capabilities within weeks of each other, it signals an ecosystem moving faster than previously assumed. The race before the race has begun, and nobody in Beijing wants to be second in line when the next breakthrough drops.

The AI Adoption Question: Why Builders Don't Use It

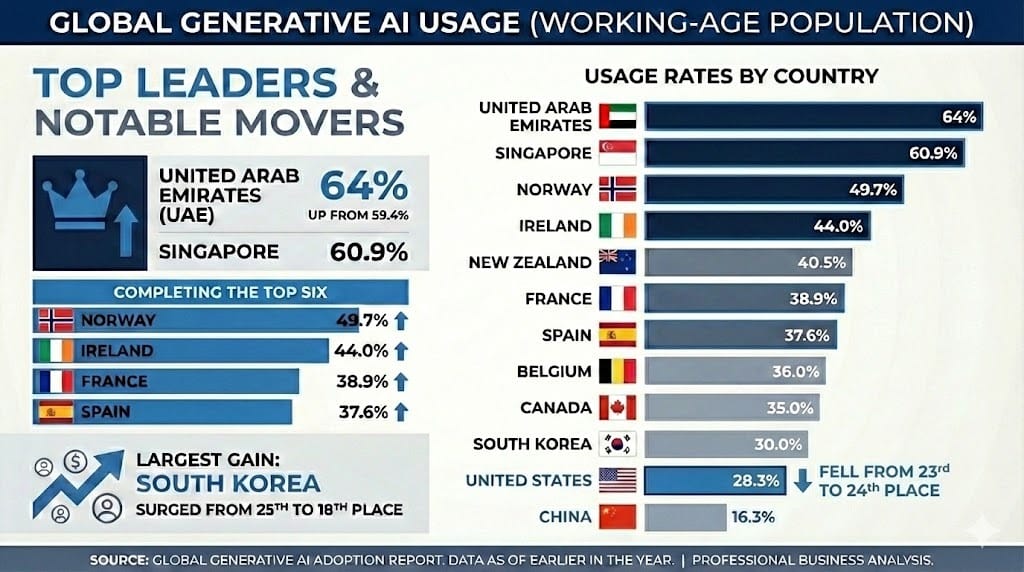

Global AI adoption reached 16.3% of the world's population in the second half of 2025, up from 15.1% earlier in the year, according to Microsoft's AI Diffusion Report. Oddly though, the countries building AI are not the countries using it the most.

The United Arab Emirates leads the world with 64% of its working-age population using generative AI, up from 59.4% earlier in the year. Singapore follows at 60.9%, Norway, Ireland, France, and Spain completing the top six. South Korea surged from 25th to 18th place, posting the largest single-country gain.

The U.S., despite leading in AI infrastructure and frontier model development, fell from 23rd to 24th place with a 28.3% usage rate. While the U.S. easily surpassed China’s 16.3% usage rate, it lagged far behind smaller, more digitized economies such as Ireland (44%), New Zealand (40.5%), Belgium (36%), and Canada (35%).

WHY THIS MATTERS: The dichotomy reveals an uncomfortable truth – that building AI systems does not guarantee widespread usage of them. Adoption appears to depend less on innovation capacity than on cultural trust, regulatory frameworks, and language accessibility. The UAE appointed a Minister of State for Artificial Intelligence in 2017, five years before ChatGPT captured global attention. Early government coordination created adoption advantages that persist even as technology evolves.

SO-WHAT: If you're deploying AI tools to a global workforce, don't assume U.S. or EU adoption patterns will translate to other markets. The UAE and Singapore models suggest that government coordination, digital infrastructure, and language drive adoption more than access to frontier models. For product strategy, the most AI-ready markets might not be the ones that produce the most AI. Scale matters of course, but the Cognitive Economy could offer scale economies in the creation of networks for the most advanced AI-adoption economies.

Micron Breaks Ground: The Memory Bottleneck Gets Real

Earlier this month, Micron Technology broke ground on a $100 billion memory manufacturing complex in Onondaga County, New York. Micron says the facility, with up to four fabs, will be the largest semiconductor facility in the country, generating 50,000 jobs and producing the high-bandwidth memory (HBM) chips critical for AI data centers.

The timing is not accidental. According to TrendForce, data centers will consume more than 70% of all the high-end memory chips produced in 2026. Little new manufacturing capacity will come online until 2027, although South Korean DRAM and flash memory producer SK Hynix is accelerating new fab timelines to meet demand.

The AI industry's appetite for memory is driving prices up across the board. As the Wall Street Journal’s Christopher Mims reported, the RAM shortage threatens to "drive up prices of all electronics and limit data-center ambitions." The memory bottleneck could constrain AI infrastructure expansion, even for companies with unlimited capital.

WHY THIS MATTERS: Memory, not compute, might become the binding constraint on AI infrastructure in 2026-27. NVIDIA's H200 and Blackwell chips require massive amounts of HBM. If memory supply can't keep pace, even the most aggressive AI capex plans will hit physical limits. This shifts leverage to memory manufacturers in ways the industry has not seen since the early smartphone era. Previously deemed boring commodities, memory chips have become highly valuable strategic enablers.

SO-WHAT: If you're planning AI infrastructure deployments for 2026-2027, factor in memory availability alongside GPU access. Procurement teams should lock in memory allocations now, while companies dependent on cloud providers should understand their providers' memory supply positions. The memory shortage could create a new class of AI haves and have-nots based on supply chain positioning instead of capital.

Africa's AI Deficiency: 18% of the World, 1% of the Compute

Africa is home to nearly one-fifth of the world's population, yet it holds less than 1% of global AI computing capacity. A new report from advisory firm Axum warns the continent could be left behind in the global technology race without urgent investment. AI could add more than $1 trillion to Africa's economy by 2030, Axum said, but African developers must wait days to process tasks that take minutes elsewhere.

The good news is that the infrastructure gap is finally attracting serious capital. Microsoft is building a $1 billion geothermal-powered data center in Kenya. NVIDIA and Cassava Technologies announced a $700 million partnership to deploy GPUs across Africa data centers. Meta completed the core build of its 2Africa subsea cable in November, the longest open-access system ever built at 45,000 kilometers. It already connects 33 countries and 3 billion people in Africa and Europe, and its 2Africa Pearls extension will connect billions more in Asia when it goes live in 2026.

Nigeria is emerging as a test case. Kasi Cloud's flagship campus in Lagos is in its final completion stages, and Airtel Nigeria is building a $120 million facility designed specifically for AI compute rather than traditional cloud storage. The African Development Bank estimates the continent needs $130 billion to $170 billion annually for infrastructure, but the funding shortfall to those levels is currently $68 billion to $100 billion.

WHY THIS MATTERS: The compute gap creates a dependency trap. Only 5% of Africa's AI talent has access to the computational power needed for research and innovation. Many rely on expensive foreign cloud credits or wait in queue behind the global hyperscalers’ priorities. The World Economic Forum identified a "compute paradox,” where new data centers risk sitting empty because GPU economics, power costs, and demand orchestration remain misaligned. Building capacity is not enough. Activating it requires coordinated investment in power, skills, and governance.

SO-WHAT FOR EXECUTIVES: Africa represents both the fastest-growing connectivity market and the largest untapped AI user base. Companies that invest now in local partnerships, data center capacity, and skills training will shape the market structure for the next decade. But entry requires patience. Market creation in African infrastructure typically requires five to seven years. For companies selling AI services globally, the compute gap means African customers might increasingly turn to alternatives such as DeepSeek that work with local constraints rather than against them. Critically, DeepSeek’s expansion in Africa is not just algorithmic. Huawei is bundling the open-source model with its own cloud computing and storage services, leveraging infrastructure it built through years of Belt and Road telecommunications projects. This gives Chinese AI a distribution advantage that pure software providers cannot match, because the model runs on hardware that Chinese companies already control.

London Greenlights Beijing's Mega-Embassy: Starmer Heads East But Excludes Infrastructure and Tech

The UK government approved China's plan for Europe's largest embassy in London on January 20, ending seven years of delays over security concerns. The £250 million project at the former Royal Mint site will be nearly 10 times larger than China's current London embassy. The approval clears the way for Prime Minister Keir Starmer to visit Beijing next week, the first UK prime minister visit since Theresa May in 2018.

Britain and China are preparing to revive a high-level business dialogue that both sides once described as a "golden era" of relations. According to Reuters, the initiative will target market-access deals for UK firms in finance, life sciences, and higher education. Starmer has criticized Conservative governments for allowing relations with Beijing to deteriorate, contrasting Britain's absence with the repeated visits made by French and German leaders since 2018.

With Washington's reliability in question after the Greenland tariff threats, the UK is signaling a renewed willingness to engage with China. An analysis by the UK-based Institute of Directors notes that "with faith in Washington wobbling, Starmer is signaling a renewed willingness to engage with China, not out of ideological warmth, but from a recognition that, in a more turbulent world, constructive cooperation matters."

WHY THIS MATTERS: Britain is signaling openness to trade, finance, and manufacturing cooperation while maintaining red lines around critical infrastructure and strategic technologies. The tech dimension is critical: the UK has banned Huawei from its 5G networks, restricted Chinese investment in semiconductor firms, and excluded Chinese companies from sensitive AI research partnerships. Any UK-China reset will need to navigate these technology red lines while finding areas for cooperation — a balancing act that will shape how middle powers manage tech sovereignty in a fragmented global order. This represents a pragmatic re-calibration rather than a full rapprochement. As Chatham House notes, Britain risks marginalization if it remains absent from major economic dialogues involving the world's second-largest economy while France and Germany maintain regular high-level contact with Beijing.

SO-WHAT: The UK-China reset creates new corridors for deal-making in finance, life sciences, and education – but with clear boundaries around defense and critical infrastructure. Companies should track which sectors get favorable treatment and which remain restricted. For firms operating in both the U.S. and UK markets, the diverging approaches to China might require separate compliance frameworks. The UK is betting it can thread the needle between Washington and Beijing. That bet affects every company with UK operations.

Saudi Arabia's Sovereign AI Play: HUMAIN Secures $1.2B at Davos

Saudi Arabia's national AI company HUMAIN secured up to $1.2 billion in financing from the Saudi National Infrastructure Fund at the World Economic Forum in Davos. The non-binding framework agreement will fund the development of up to 250 megawatts of hyperscale AI data center capacity. These facilities will use advanced GPUs for AI training and inference, supporting clients across local, regional, and international markets.

HUMAIN, wholly owned by the Public Investment Fund (PIF), launched last May as part of the Kingdom's bet on AI to diversify its economy away from oil. The company will operate throughout the AI value chain, providing data centers, cloud infrastructure, advanced AI models, and what it describes as "one of the most powerful multimodal Arabic language large models."

The move follows a November 2025 partnership with NVIDIA after U.S. officials cleared the way for the sale of advanced microchips to the Gulf kingdom. The first phase will deploy 18,000 NVIDIA GB300 Grace Blackwell GPUs, the company’s most advanced AI processors. Google Cloud and PIF also advanced a $10 billion partnership to build and operate a global AI hub in Saudi Arabia, featuring the latest tensor processing units (TPUs) and GPU accelerators. Saudi Arabia and the UAE are now competing head-to-head to become the Middle East's AI hub.

WHY THIS MATTERS: Sovereign AI infrastructure ensures that data processing and intellectual property remain within Saudi borders. The Kingdom is not just buying AI services, it is building the capacity to train its own models and create its own IP. This is AI sovereignty in practice, not just aspiration. With technology spending in the MENA region projected to reach $169 billion in 2026, according to Gartner, the Gulf states are emerging as a third pole in the AI infrastructure race alongside the U.S. and China. Who will be next? Visakhapatnam, Gujarat and Noida (India), Johor (Malaysia), Sines (Portugal), Paris (France), Kristiansand (Norway), Frankfurt and Berlin (Germany) have all announced or launched significant AI-related investments, and Astana (Kazakhstan) is well positioned to join an up-and-coming tier with Central Asian compute that's currently favored by U.S. decision makers.

SO-WHAT: Gulf state AI investments create procurement opportunities for infrastructure providers, model developers, and enterprise software companies. But the emphasis on "sovereign" AI means partnerships will come with data residency requirements and local content mandates. For companies selling to Middle East governments and regulated industries, understanding the HUMAIN and G42 (UAE) ecosystems will be as important as understanding AWS or Azure.

Under the Radar

The deep analysis that connects the dots

The AI Productivity Paradox and the $115 Billion Question

Product launches, capital flows, energy consumption, and geopolitical flashpoints dominate the AI headlines, but a set of numbers that don’t quite add up might emerge as a far more consequential story.

On January 18, OpenAI CFO Sarah Friar noted in a blog post that the company reached $20 billion in annualized revenue during 2025 – a 233% year-over-year increase and a growth curve that outpaces the most dominant Silicon Valley unicorns in history. Yet, still, the company is projected to lose $17 billion in 2026, with 85% allocated to compute costs. The company’s cumulative losses by 2029 are projected to reach $115 billion.

HSBC Bank examined OpenAI's roadmap to profitability and was not convinced. The bank’s analysts estimated that OpenAI would need $207 billion in new financing by 2030, just to balance the books.

The Conversion Problem: More than 800 million people use ChatGPT every week, but fewer than 5% pay for it. ChatGPT generates roughly 70% of OpenAI's annual recurring revenue, but the company loses money on Pro Plans. If 95% of users never upgrade, no amount of capability improvement closes the gap between costs and revenue.

The Anthropic Economic Index: Meanwhile, rival Anthropic released new research that illuminates where AI actually delivers economic value. Their findings reveal what they call the “Speedup Paradox.” High school-level tasks see a 9x acceleration from AI assistance. College-level tasks see a 12x speedup. The more complex the work, the company said, the greater the productivity gain. This inverts conventional assumptions about automation, with AI replacing simple tasks but also amplifying the productivity of sophisticated knowledge work.

The Geography of Adoption: The Anthropic data reveals a stark geographic concentration. A 1% increase in GDP per capita correlates with a 0.7% increase in Claude usage. Singapore uses Claude at 4.6-times its population share. India uses it at 0.27 times. The pattern echoes previous technological revolutions. Early adoption concentrates in wealthy regions, productivity gains compound where adoption is highest, and the digital divide becomes an AI divide. Only this time, the timeline is compressed from decades down to years.

Automation vs. Augmentation: 77% of enterprise API usage exhibits automation patterns. Businesses are not using AI to augment human work, they are delegating complete tasks. This marks a structural shift from the “AI as copilot” framing that dominated 2023-2024 discourse. Enterprises are building AI directly into production workflows and removing human intermediaries from routine processes. For consumer users, the split is closer to 50-50, but the enterprise pattern signals where the market is heading.

The Productivity Puzzle: For 15 years, U.S. labor productivity growth has stagnated between 0.5% and 0.8% annually. The cloud computing revolution and the SaaS boom did not move the needle. Anthropic estimates AI adoption could add 1.2 percentage points to annual U.S. labor productivity growth — potentially doubling the current baseline rate to approximately 2% annually — over the next decade. That would make the U.S. economy 13% more productive cumulatively by 2036, yielding trillions of dollars in additional GDP. But the gains accrue to those who adopt, and adoption requires infrastructure, capital, and organizational capacity that concentrate in already-wealthy regions.

The Investment Thesis Under Stress: AI demonstrably delivers productivity gains. Enterprises are adopting it at unprecedented speed. Usage is growing faster than any technology in history. And yet the companies building the foundational models cannot make the economics work. This challenge extends beyond OpenAI. Anthropic expects to burn $6 billion to $9 billion in 2026 before reaching break-even in 2028, while xAI is reportedly burning nearly $1 billion per month on infrastructure. The pattern differs in China, where major AI players such as Alibaba and Baidu are already profitable companies, cross-subsidizing AI development from existing revenue streams in a place where investor patience for pure-play AI startups is notably shorter. OpenAI's path to profitability requires either conversion rates that defy consumer software precedent or enterprise pricing that captures the full productivity surplus that AI generates. Neither has materialized yet, and the latter would require a hard pivot that could slow adoption when many enterprises are still experimenting with their ROI pathways.

What's Next: Watch for a bifurcation in the AI market. Consumer-facing AI might consolidate around a few players who can subsidize free tiers through adjacent revenue streams. Enterprise AI will likely see aggressive pricing experiments as vendors test how much productivity surplus they can capture. The open-source alternatives, such as DeepSeek, could gain strategic importance precisely because they break the link between AI capability and the capital-intensive business models of frontier labs. The companies that survive the next two years will be those that solve the conversion problem or find alternative paths to financial sustainability. The productivity gains are real, but the business models to capture them remain elusive.

The AI revolution is happening. Whether its architects can afford to build it is the $115 billion question.

Cambrian Partner By Invitation

Expert analysis from our global network

Vietnam's 14th Party Congress Reframes AI and Compute Investment Priorities

Vietnam has concluded its 14th National Party Congress, a five-year political reset that culminated in a 2026 resolution targeting sustained annual GDP growth of around 10 percent through 2030. Unlike previous cycles, growth is now explicitly anchored in artificial intelligence, semiconductors, and advanced digital infrastructure. The resolution positions science and technology as primary productive forces and sets an ambition for the digital economy to account for roughly 30 percent of GDP by 2030. For foreign firms, this signals a tectonic shift. Vietnam no longer frames competitiveness through labor arbitrage alone, but through inward investment in compute capacity, applied AI research, and system-level R&D capabilities tied to domestic value creation.

What should companies do now

First, recalibrate Vietnam strategies from manufacturing scale to compute-enabled R&D presence. Firms should assess where local AI laboratories, high-performance computing infrastructure, data centers, or joint research platforms align with national priorities and emerging incentive regimes, including high-tech tax incentives, "Make in Vietnam" localization requirements, and preferential treatment for firms that embed research, design, and applied development onshore. Second, integrate talent acquisition and development into investment design through structured partnerships with universities and applied research institutes, rather than relying on downstream hiring alone. Third, treat AI governance as an entry condition, not a compliance afterthought. Early alignment on transparency, reliability, and accountability will shape access to regulators, data, and long-term policy trust as Vietnam's AI framework matures.

About the partners

Adam Tatarynowicz is Full Professor of Strategy & Innovation at Nova School of Business and Economics in Portugal, and a Visiting Professor at RMIT University Vietnam and Singapore Management University. Burkhard Schrage is Associate Professor of Management at RMIT University Vietnam. Together, they advise governments, universities, and multinational firms on innovation strategy, digital transformation, and emerging market R&D ecosystems. Their work focuses on how AI, compute infrastructure, and institutional design shape long-term competitiveness in Southeast Asia and beyond.

About Cambrian

Cambrian Futures is a strategic foresight and advisory firm helping government, business, and technology leaders understand how emerging technologies intersect with geopolitics, markets, and national strategy. By combining rigorous research, AI-enabled analysis, and human expertise, Cambrian provides clear insight into global technology trends, risks, and power dynamics. Its work helps decision-makers anticipate disruption, manage uncertainty, and act with strategic confidence in an increasingly competitive GeoTech world.

PRODUCTION TEAM

GeoTech Radar is produced by the Cambrian Futures Insights Platform team:

CEO & Chief Analyst

Managing Director / Producer, Insights Platform

Global Lead, Smart Infrastructure Strategy

Editor in Chief

Learn more about Cambrian Futures at cambrian.ai