Copenhagen Digs In. Ottawa Pivots. The Stack Wars Begin.

IN THIS ISSUE:

A Note From the Executive Editor

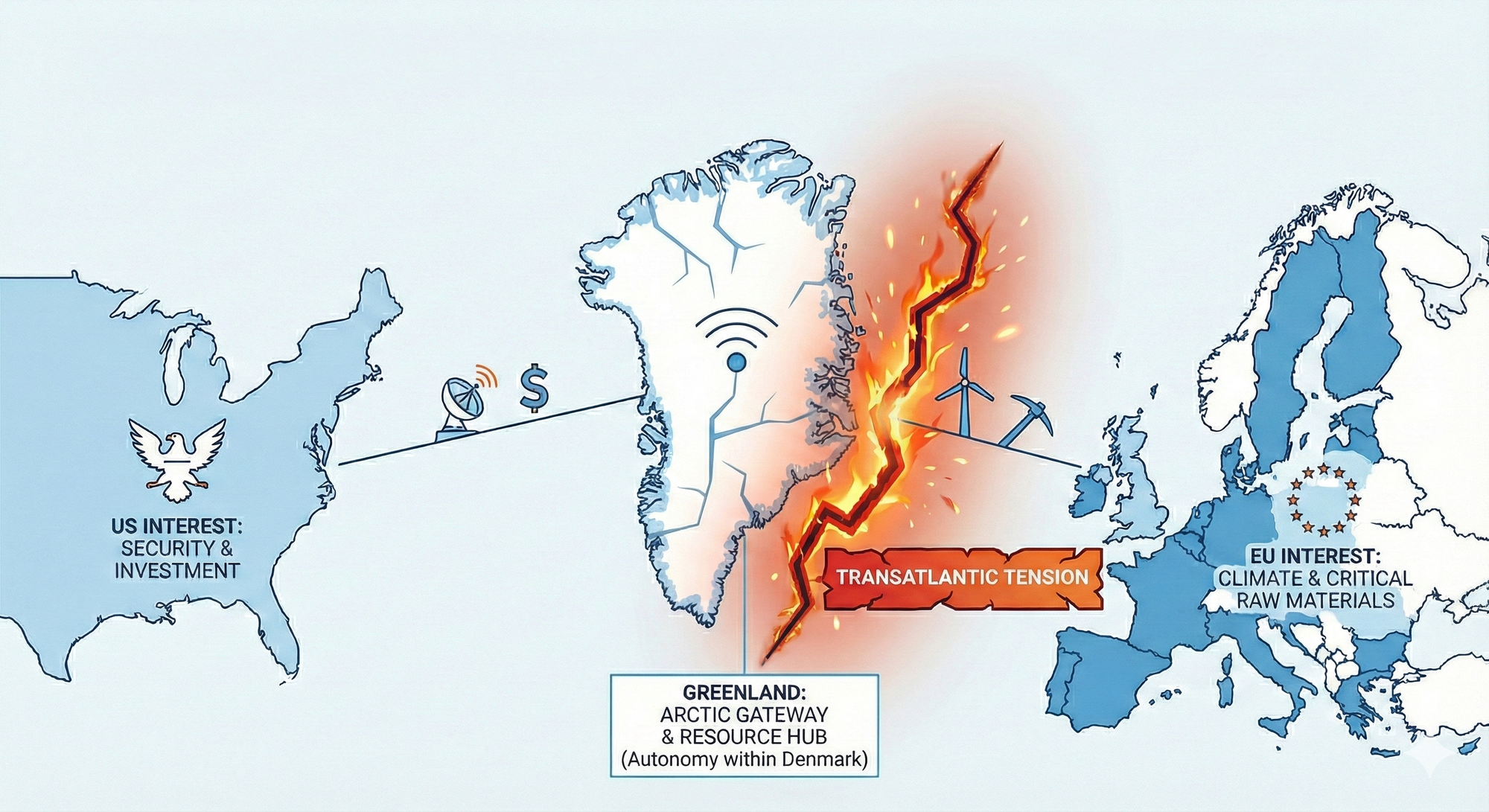

Never in my wildest dreams over the past 30+ years in the US did I imagine a European official openly mentioning the possibility of war between the US and other NATO allies, as Denmark’s defense minister did yesterday in response to President Trump's insinuation that use of force was on the table. Since then, Trump has backpedaled on both the use of force and the tariff hits, claiming a “framework” with NATO and calling for “immediate negotiations to once again discuss the acquisition of Greenland by the United States”. . But make no mistake about it - the damage is done: China is laughing all the way to the bank. It will also accelerate its Taiwan takeover plans. Such is the sad state of strategic simple-mindedness in our world that rewards social media clicks for conquerors over the enduring legacy of world-builders.

Greenland is being framed in the US as a fight over access: Minerals. Sea lanes. Basing. But the US already has what it needs. The 1951 US–Denmark defense framework has long enabled a strong American footprint. What is being demanded now is dominance, not necessity. Europe, and really allies far and wide, hear coercion, not strategy, intimidation not reliability. So the response is turning hard. Brussels is weighing the EU Anti-Coercion Instrument, the so-called trade bazooka. That can move beyond tariffs. It can hit services, procurement, and intellectual property. The minute Europe debates sanctioning US tech, Greenland becomes a stress test for the West’s tech wiring, and indeed the global economy.

Retaliation will hurt fast. US tech loses a major profit pool. European consumers and firms will immediately suffer as well with few local alternatives in place. Can Europe win this? From an economic standpoint, that’s doubtful. But life is not all about economics. Sometimes you need to take a stance and take the hit. But that's only the start: If you treat tech and the transatlantic relationship as collateral damage, you risk a growth shock that spills worldwide. A transatlantic tech rupture would not just dent US GDP (tech contributes 92% of GDP growth here). US bond backed assets globally would tank. The global US-led AI buildout would slow. Less effective islands of disconnected and homegrown "sovereignty" would proliferate. It would also widen openings for Chinese substitutes. And it would raise the odds of yet more globally distributed militarized competition, bringing death and destruction and also global recessions. None of this is good for business and leaders need to speak up.

In the medium run, Washington pays another price. Threats against trusted allies have triggered a welcome boost in EU spending on NATO, yes, but a whole campaign of them burns relationship equity for no gain. In a G2+X world, clubs hold because norms are shared and loyalty is real. Break that and partners hedge. Some drift toward the other camp if its rules look steadier. US power is not infinite. The world is already toggling.

ON THE RADAR

The signals effecting the GeoTech landscape this week.

Ottawa's Beijing (EV) Pivot

Prime Minister Mark Carney’s trade agreement with Beijing slashes tariffs on Chinese EVs from 100% to 6.1% in exchange for China reopening its $3 billion canola market.¹ The deal drops Chinese EV duties to pre-Trudeau levels while inviting “considerable” Chinese joint-venture investment in Canada’s auto sector.

This is not merely trade policy. It is a G7 nation explicitly signaling that American pressure tactics have pushed it toward Beijing. Carney himself underscored the point: “In terms of the way our relationship has progressed in recent months with China, it is more predictable.”²

The math reveals the desperation. Canada’s total bilateral trade with China sits around $80 billion annually. Its U.S. trade approaches $1 trillion. Carney is not replacing American commerce. He is hedging against what Ottawa now treats as an unreliable ally.

Implications: President Trump expressed support for the deal, but other administration officials called it a move Canada would “surely regret.” Beijing gets a foothold inside what was supposed to be Fortress North America. Ontario Premier Doug Ford was blunter: “The federal government is inviting a flood of cheap made-in-China electric vehicles without any real guarantee.”³

So-What: Does your North American supply chain assume U.S.-Canada policy alignment? Chinese joint ventures in Canadian auto manufacturing could reshape the regional supplier landscape within 18 months. Boards should stress-test assumptions about “Fortress North America” as a unified trade bloc.

Pax Silica: The AI Alliance Excluding Europe

In December 2025, the United States launched “Pax Silica,” a tech alliance designed to secure the AI supply chain while pointedly excluding the European Union as an institution.⁴ Founding signatories include Japan, South Korea, Singapore, the Netherlands, Israel, the UAE, the UK, and Australia. The EU, Canada, and Taiwan were relegated to “guest” status.

The exclusion is remarkable given European firms’ critical roles in the semiconductor stack. Consider the major firms Washington is asking allies to build without. ASML (Netherlands) holds a global monopoly on EUV lithography. BE Semiconductor Industries (Netherlands) leads in advanced chip packaging. NXP (Netherlands) dominates automotive and industrial semiconductors. Infineon (Germany) is a power IC leader. STMicroelectronics (France/Italy) supplies automotive and industrial chips. Air Liquide (France) provides essential process gases. Merck KGaA (Germany) manufactures critical process materials.⁵

Implications: The Netherlands signed onto Pax Silica individually, but the broader EU did not. Jacob Helberg, the U.S. official leading the initiative, stated that participants must be “fundamentally aligned with the United States on broader geopolitical issues.”⁶ The EU’s DSA and DMA enforcement appears to have disqualified the bloc as a whole.

So-What: If your semiconductor supply chain runs through EU-based suppliers (and it probably does), you now face bifurcated policy frameworks. Pax Silica may promise “priority access” to U.S. technologies, but the actual hardware often originates in EU jurisdictions not party to the agreement. Procurement teams should map which suppliers fall under which framework.

Rubio Bans European Officials Over "The Digital Censorship"

Secretary of State Marco Rubio issued visa bans on five European officials on December 24, 2025, accusing them of leading a “global censorship-industrial complex.”⁷ The sanctioned individuals are Thierry Breton (France), former EU Commissioner for Internal Market and architect of the Digital Services Act. Imran Ahmed (UK), CEO of the Center for Countering Digital Hate. Clare Melford (UK), CEO of the Global Disinformation Index. And Anna-Lena von Hodenberg and Josephine Ballon (Germany), co-leaders of HateAid.

The move transforms a regulatory dispute over content moderation into a diplomatic confrontation. French President Macron condemned the bans as “intimidation and coercion.” Breton responded on X, asking “Is McCarthy’s witch hunt back?”⁸

Implications: This signals the administration will shield U.S. tech firms from foreign digital sovereignty laws. The EU has indicated it “will respond swiftly and decisively.”⁹ Retaliatory measures against U.S. tech giants with operations in Europe could further fragment the Western digital market.

So-What: If your company operates platforms subject to DSA/DMA enforcement, how do you navigate compliance when the U.S. government treats EU regulators as hostile actors? Companies with transatlantic digital operations should scenario-plan for regulatory fragmentation that makes unified compliance impossible.

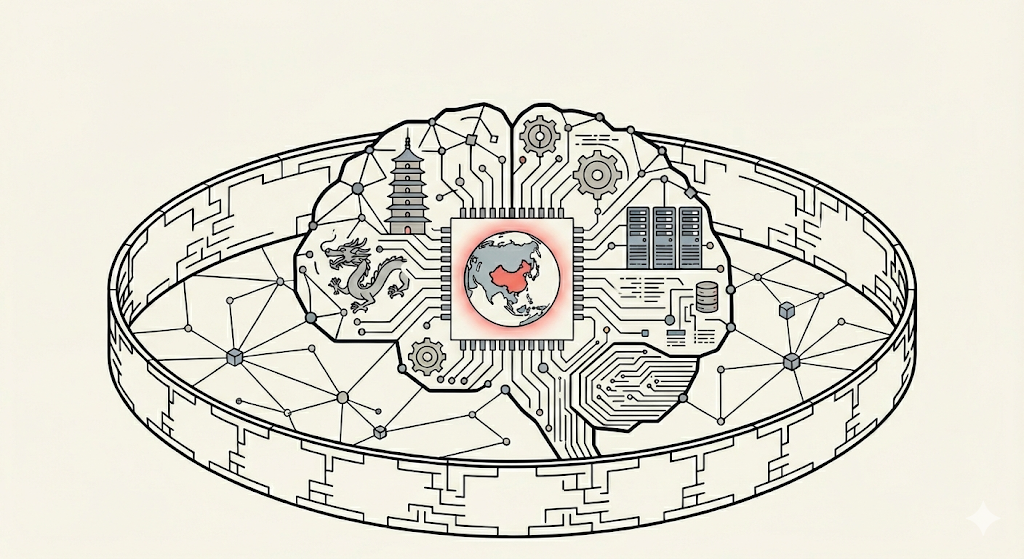

Beijing's Global South AI Pivot

While the U.S. focuses on exclusive tech blocs, Beijing has been solidifying its role as the primary AI partner for the Global South. In July 2024, China secured unanimous adoption of a UN General Assembly resolution on AI capacity-building, co-sponsored by more than 140 countries.¹⁰ The resolution emphasized helping developing nations build AI infrastructure, including data centers and local compute capacity.

China has followed with concrete initiatives. It unveiled its AI Capacity-Building Action Plan in September 2024. Workshops in Shanghai and Beijing drew participants from more than 40 countries. The “Group of Friends for International Cooperation in AI Capacity-Building” has convened multiple times since its launch in December 2024.¹¹ By offering “21st-century infrastructure” at subsidized prices, China is positioning its standards as the default foundation for emerging economies.

Meanwhile, U.S. engagement has faltered. The State Department dismissed diplomats from the Bureau of Cyberspace and Digital Policy in July 2025, effectively splitting the bureau responsible for international tech initiatives.¹²

Implications: If China succeeds in building the “electric stack” for the Global South, it gains commercial and data-collection advantages that American soft power might not overcome.

So-What: If your company serves or sources from emerging markets, who built the digital infrastructure you’re operating on? Chinese-built systems might embed different standards, protocols, and data-sharing assumptions. The window to shape these foundations is closing.

China's First All-Domestic AI Model

Beijing-based AI startup Zhipu announced on January 14, 2026 that its GLM-Image model completed training entirely on Huawei’s Ascend chips.¹³ The company, blacklisted by the U.S. Commerce Department in 2025 for alleged military ties, used Huawei’s Ascend Atlas 800T A2 servers and the MindSpore framework for the full pipeline from data preprocessing to production.

GLM-Image is a 16 billion-parameter multimodal model combining a 9 billion-parameter autoregressive generator and a 7 billion-parameter diffusion decoder.¹⁴ Zhipu developed custom optimization techniques including dynamic graph multi-level pipelined deployment and high-performance fusion operators to extract performance from Huawei’s architecture.

Zhipu priced the model aggressively at 0.1 yuan (~1.4 cents) per generated image and open-sourced the weights. The company’s stock has surged 80% since its Hong Kong IPO last week.

Implications: Huawei claims its Ascend 910C delivers approximately 80% of Nvidia’s H100 performance at FP16 precision.¹⁵ Several caveats apply. This benchmark is workload-specific. Zhipu did not disclose how many servers or how long it took to train its system compared with equivalent Nvidia systems. The last 20% of the performance gap might prove disproportionately difficult to close, and GLM-Image is a multimodal image generation model, not a frontier language model.

So-What: For companies operating in China, this proves that competitive AI development can occur on domestic infrastructure. Your China operations might need to evaluate strategies around Huawei’s Ascend and MindSpore. For semiconductor investors, the question is whether export controls are slowing or accelerating the development of parallel AI ecosystems.

The AI Inference Gap No One Is Talking About

Nvidia dominates AI training, but inference is emerging as a different battlefield. For inference workloads, which run already-trained models in production, purpose-built architectures are claiming order-of-magnitude performance advantages over GPUs.

Key players to watch. Groq uses Language Processing Units with deterministic execution, claiming 10x faster inference than GPUs for certain models.¹⁶ Cerebras uses wafer-scale engineering with on-chip SRAM to eliminate memory bottlenecks. Qualcomm’s Snapdragon X series is gaining traction for edge inference, particularly in Middle East and Asia markets, where energy costs dominate total cost of ownership. Amazon’s Inferentia and Trainium chips now power a growing share of AWS AI inference workloads.

Training happens once. Inference happens every time someone queries an AI system. As deployment scales, inference will consume an increasingly large share of AI compute spending.

Implications: Nvidia is not standing still. Its Blackwell architecture improves inference performance. But the company’s core competency is general-purpose GPU architecture. Pivoting to specialized inference means competing against startups optimized for nothing else.

So-What: The AI race might have two finish lines, and leading one does not guarantee leading both. When evaluating AI infrastructure investments, distinguish training requirements (where Nvidia dominates) from inference requirements (where alternatives could offer better economics). Energy consumption matters, especially for inference at scale.

On Your Radar: Technology infrastructure is bifurcating. China demonstrates it can train competitive models without Western hardware. Purpose-built inference chips threaten Nvidia’s assumed dominance in AI deployment. The stack is fragmenting into parallel ecosystems with different chokepoints and different winners.

The Venezuela Energy x Tech Dividend

The removal of Nicolás Maduro and his subsequent trial in the U.S. has “reopened” Venezuela, home to the world’s largest proven oil reserves, to Western capital.¹⁷ As of January 15, the energy sector has added more than $100 billion in market value, with Chevron leading a massive rally in anticipation of stabilized output from the Orinoco Belt.

Washington is treating the regime change as a landmark victory for “energy dominance,” redrawing global oil supply to favor Western-aligned production.

Implications: While markets are celebrating, the transition remains fraught. Heavy-handed American tactics risk populist backlash that could destabilize the very infrastructure investors are rushing to fund.

Not all energy majors share the enthusiasm. TotalEnergies CEO Patrick Pouyanné said a return to Venezuela is "not a priority," noting that restoring production to pre-crisis levels would require $100 billion and take years. ExxonMobil's Darren Woods went further, calling the country "uninvestable" without major reforms. Shell has expressed interest in offshore gas projects but remains publicly cautious about the regulatory environment. Chevron's head start, maintained through OFAC waivers during the Maduro era, may prove a durable advantage if competitors stay on the sidelines.

So-What: Venezuelan stabilization has direct AI infrastructure implications. Data center operators face a structural power shortage. The PJM grid alone is projected to fall 6 gigawatts short of reliability requirements by 2027.¹⁸ Additional oil supply from Venezuela could moderate energy costs precisely when AI compute demand is spiking. Oil analysts project Brent could decline $5-10/barrel if Venezuelan production reaches pre-crisis levels within three years.¹⁹ For boards evaluating AI infrastructure investments, energy cost assumptions might need revision.

Credit Spreads Hit 2007 Levels

Global credit markets are running at their tightest levels since June 2007. The yield premium that investors demand to hold corporate debt over government bonds has fallen below one percentage point.²⁰ Pimco and Aberdeen Investments are warning of complacency. Goldman Sachs is urging clients to hedge.

The GeoTech connection is direct. Tech is now the primary engine of credit market growth, with the five major AI hyperscalers – Amazon, Alphabet, Meta, Microsoft, and Oracle – issuing $121 billion in U.S. corporate bonds in 2025, versus an average $28 billion per year from 2020-2024.²¹ Barclays forecasts total U.S. corporate bond issuance will reach $2.46 trillion in 2026, with the increase “largely a non-financial story” driven by AI capex.²²

The AI buildout is front-loading investment while back-loading revenue. BlackRock notes this means “greater overall leverage in the system is inevitable.”²³

Implications: The last time spreads were this compressed, markets were pricing in permanent stability months before the global financial crisis. Tight spreads reflect optimism, but also collective certainty that good times continue indefinitely. Spreads on AI-heavy bonds have already widened by 40 basis points since September.

So-What: The AI infrastructure buildout is creating new systemic leverage. If you are financing AI capex through debt markets, rising spreads could increase costs precisely when you are scaling. If you are investing in companies dependent on continued AI infrastructure growth, their financing assumptions may prove fragile.

Wall Street's Record Trading Year

The six largest U.S. banks, JPMorgan, Bank of America, Citigroup, Wells Fargo, Goldman Sachs, and Morgan Stanley, generated $593 billion in combined revenue for 2025, a 6% increase and the highest on record.²⁴ Combined profits reached $157 billion, up 8% year-over-year.

Much of the strength came from trading desks. Goldman Sachs retained its position as top equities trader with $16.5 billion in revenue, up 23%.²⁵ Morgan Stanley and JPMorgan recorded even faster growth at 28% and 33%, respectively.

This is what happens when volatility becomes structural. Trade wars, currency dislocations, and AI-fueled market swings created continuous opportunities for market-making desks. The banks are not predicting the chaos, they are profiting from it.

Implications: Bank stocks fell after earnings anyway. Rising costs, cautious forward guidance, and credit concerns offset the trading bonanza. Even record revenue cannot paper over questions about what happens when volatility normalizes.

So-What: What destabilizes corporate planners feeds Wall Street’s largest profit centers. If your company hedges currency, commodity, or rate exposure, you are paying into the volatility dividend. The structural incentives now favor continued instability.

UNDER THE RADAR

SOVEREIGN COMPUTE DEBT

When national power was measured by territory and tanks, states fought for land. In the medium term, power is shifting toward the ability to sustain the “cognitive stack” required for a modern society to function. We are entering the era of Sovereign Compute Debt, where nations that fail to build their own AI infrastructure will face structural dependencies on those that do.

This does not mean every country must develop its own sovereign compute stack. But with increasing shifts in loyalties and allegiances in what we have termed the “G2+X world,” where the U.S.-China bipolar competition forces other nations to navigate between great powers, countries need basic compute resilience within their national or regional borders.²⁶

The Energy-Water Convergence

The strategic insight for 2026 is that the AI race is about to collide with physical resource limits. Data centers are now strategic high ground, requiring massive power and fresh water. In parts of the U.S. and Europe, water rights are becoming as contentious as land rights because AI cooling systems compete with local agriculture.²⁷ Countries that can solve the “energy-water nexus” will be the ones capable of hosting the next generation of sovereign AI.

The Fragmentation of the Mind

As the EU and U.S. diverge on regulation, we are seeing the end of the “universal internet.” If the U.S. continues to treat EU regulators as hostile actors, it will create a world where AI models are trained on incompatible sets of “truth” and “ethics.” A nation’s algorithmic sovereignty will soon be its most important defense, as relying on foreign AI for public administration or military command creates vulnerabilities that no treaty can fix.

The Strategic Implication

The medium-term risk is a “digital domino effect.” If a major AI provider is geofenced by sanctions or fails due to resource shortages, dependent countries face immediate structural paralysis. The winners will be nations that use current volatility to build circular tech ecosystems, where energy, water, and compute power are managed as a single sovereign asset cluster.

The Questions to Ask

Does the national or regional AI strategy you design or by which you are governed account for localized water, energy, and minerals scarcity caused by data centers?

What happens to your domestic economy if your primary AI provider is sanctioned by a major trade partner?

Are you building a platform for your own sovereignty or merely paying rent on someone else’s algorithm?

CAMBRIAN PARTNER BY INVITATION

The Curse of Speed: When AI Accelerates Faster Than Governance

Last week's KPMG Q4 AI Pulse Survey revealed a telling split. According to the survey, 75% of enterprise leaders now cite security, compliance, and auditability as their most critical requirements for agent deployment, while 60% restrict agent access to sensitive data without human oversight. The concern is not hypothetical. Organizations are moving from pilots to production at speed, deploying agents, copilots, and automated decision systems across customer operations, finance, and supply chains. At the same time, regulators and boards are signaling concern about accountability gaps, model risk, and opaque decision-making. The tension is not about whether AI works. It is about whether institutions can govern intelligence as it becomes operational. What matters now is not faster deployment, but the ability to see early when speed is turning into fragility. By the time customer trust or financial metrics move, governance failure is already embedded.

What should companies do now

First, anchor AI oversight to customer value. Ethics and economics are joined at the hip. If activity increases without measurable improvement in customer trust or outcomes, pause before scaling. Second, make escalation explicit. Define which AI decisions require human review, who owns overrides, and how disagreement is surfaced safely. Third, govern use cases, not AI in the abstract. Different applications carry different risk and accountability profiles. Finally, treat internal signals as leading indicators. When teams stop questioning outputs, silence is not alignment. It is a warning sign.

About Human × AI

Karine Allouche is Founder and CEO of Human × AI, a research and advisory practice working with boards and senior leaders to govern AI as a value-creating system. As a former enterprise operator, she focuses on decision architecture, governance design, and transformational leadership capacity at scale. The goal is not slower AI, but AI that compounds advantage without eroding judgment, trust, or accountability.

The Curse of Speed: When AI Accelerates Faster Than Governance

Last week's KPMG Q4 AI Pulse Survey revealed a telling split. According to the survey, 75% of enterprise leaders now cite security, compliance, and auditability as their most critical requirements for agent deployment, while 60% restrict agent access to sensitive data without human oversight. The concern is not hypothetical. Organizations are moving from pilots to production at speed, deploying agents, copilots, and automated decision systems across customer operations, finance, and supply chains. At the same time, regulators and boards are signaling concern about accountability gaps, model risk, and opaque decision-making. The tension is not about whether AI works. It is about whether institutions can govern intelligence as it becomes operational. What matters now is not faster deployment, but the ability to see early when speed is turning into fragility. By the time customer trust or financial metrics move, governance failure is already embedded.

What should companies do now

First, anchor AI oversight to customer value. Ethics and economics are joined at the hip. If activity increases without measurable improvement in customer trust or outcomes, pause before scaling. Second, make escalation explicit. Define which AI decisions require human review, who owns overrides, and how disagreement is surfaced safely. Third, govern use cases, not AI in the abstract. Different applications carry different risk and accountability profiles. Finally, treat internal signals as leading indicators. When teams stop questioning outputs, silence is not alignment. It is a warning sign.

About Human × AI

Karine Allouche is Founder and CEO of Human × AI, a research and advisory practice working with boards and senior leaders to govern AI as a value-creating system. As a former enterprise operator, she focuses on decision architecture, governance design, and transformational leadership capacity at scale. The goal is not slower AI, but AI that compounds advantage without eroding judgment, trust, or accountability.

ABOUT CAMBRIAN

Cambrian Futures is a strategic foresight and advisory firm helping government, business, and technology leaders understand how emerging technologies intersect with geopolitics, markets, and national strategy. By combining rigorous research, AI-enabled analysis, and human expertise, Cambrian provides clear insight into global technology trends, risks, and power dynamics. Its work helps decision-makers anticipate disruption, manage uncertainty, and act with strategic confidence in an increasingly competitive GeoTech world.

PRODUCTION TEAM

GeoTech Radar is produced by the Cambrian Futures Insights Platform team:

CEO & Chief Analyst

Managing Director / Producer, Insights Platform

Deputy Producer, Insights Platform

Editor in Chief

Learn more about Cambrian Futures at cambrian.ai